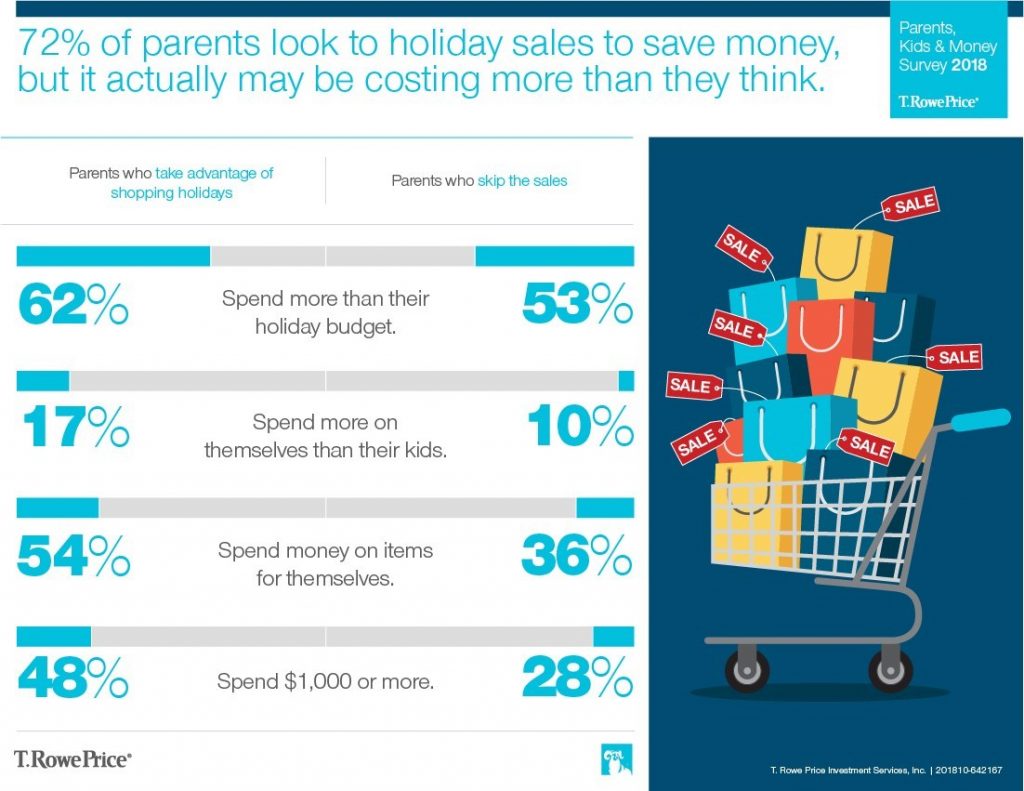

A new survey by T. Rowe Price found that parents who try to get everything on their kids’ holiday wish lists are more likely to report that they have gone into debt for their kids, worry that they’re spoiling their kids, and have kids who are less likely to save their own money. Additionally, parents who participate in promotional days, such as Black Friday and Cyber Monday, are more likely to splurge. Key findings include:

- 47% of parents agree with the statement, “I try to get everything on my kids’ lists, no matter the cost.”

- Who finances their holiday spending: 51% of parents who try to get everything on their kids’ lists, versus 44% of other parents

- Who has gone into debt to pay for something their kids wanted: 48% of parents who try to get everything on their kids’ lists, versus 26% of other parents

- Who has retirement savings: 42% of parents who try to get everything on their kids’ lists, versus 56% of other parents

- Who currently has a payday loan: 10% of parents who try to get everything on their kids’ lists, versus 4% of other parents

- Who has tried various ways to get their kids to save their money, instead of spending it right away, with no luck: 69% of parents who try to get everything on their kids’ lists, versus 51% of other parents

- Who has kids who spend their allowances as soon as they receive it: 56% of parents who try to get everything on their kids’ lists, versus 38% of other parents

- Also, 46% say they use credit cards to finance their holiday spending, or have taken a payday loan to cover it; That includes 22% of parents who continue to pay off credit card balances from holiday spending more than six months after the holidays

- 59% say they agree with the statement “I spent more on the holidays than I should have”

- 48% agree with the statement, “I never stick to my holiday spending budget”

- 15% agree with the statement, “I spent more on myself than my kids”

EastTexasRadio.com Powered by Ten Stations

EastTexasRadio.com Powered by Ten Stations