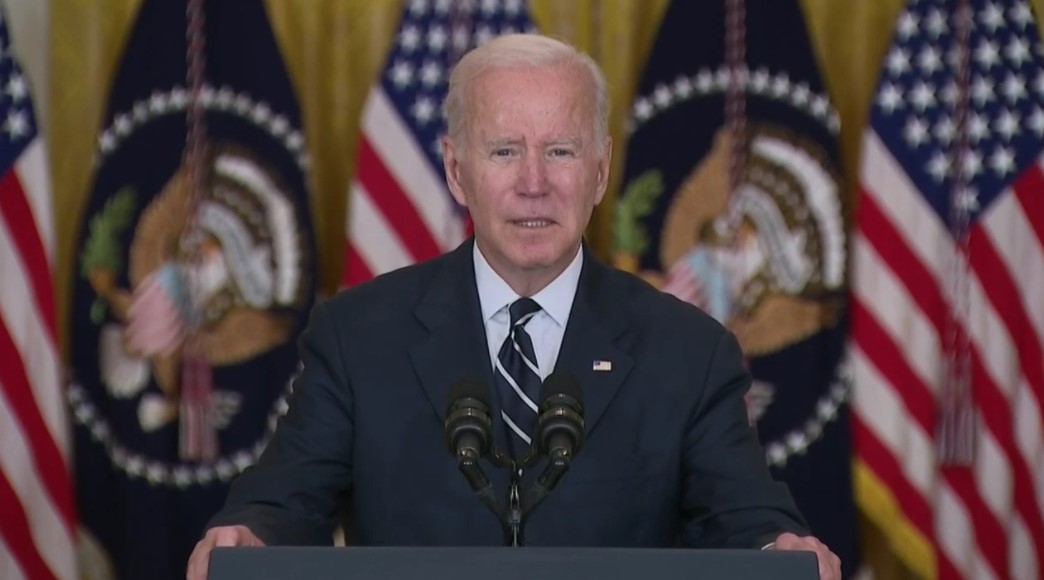

President Joe Biden declared Thursday he has reached a “historic economic framework” with Democrats in Congress on his sweeping domestic policy package, a hard-fought yet dramatically scaled-back deal announced hours before he departs for overseas summits.

According to senior administration officials who requested anonymity to brief reporters about the emerging details, paid family leave and efforts to lower prescription drug pricing are now gone entirely from the package.

Here’s what’s still in the package:

- Universal preschool for all 3-and 4-year-olds funded for at least six years

- Subsidized child care that caps what parents pay at 7% of their income

- A one-year extension of the current enhanced Child Tax Credit

- Expand free school lunch programs and provide $65 per child per month to purchase food during the summer

- Expanded Medicare coverage to include the launch of a $35 billion new hearing aid benefit for seniors

- Extend the current, pandemic-related Affordable Care Act subsidies for four years

- Expanded tax credits for ten years for utility and residential clean energy, including electric vehicles.

- Increasing access to affordable housing with a plan to build and renovate more than one million affordable homes

- Extend the expanded Earned Income Tax credit for low-wage workers

- Increase Pell Grants and strengthen its access to DREAMERS

- $555 billion to tackle climate change and tax credits for solar panels, electric vehicles, and clean energy production.

- $100 billion to bolster the legal immigration and border processing system.

Biden’s proposal, which he called “fiscally responsible and fully paid for,” would be funded by imposing a new 5% surtax on individual income over $10 million a year. Officials said that that rate would rise another 3% on income above $25 million, keeping with his plans to have no new taxes on those earning less than $400,000 a year.

The plan, if passed, would also institute a new 15% minimum tax on corporate profits and adopt the Treasury Department-brokered 15% minimum global tax. It also includes a 1% surcharge on corporate stock buybacks, which the Biden administration believes “corporate executives too often use to enrich themselves rather than investing workers and growing their businesses.”

EastTexasRadio.com Powered by Ten Stations

EastTexasRadio.com Powered by Ten Stations