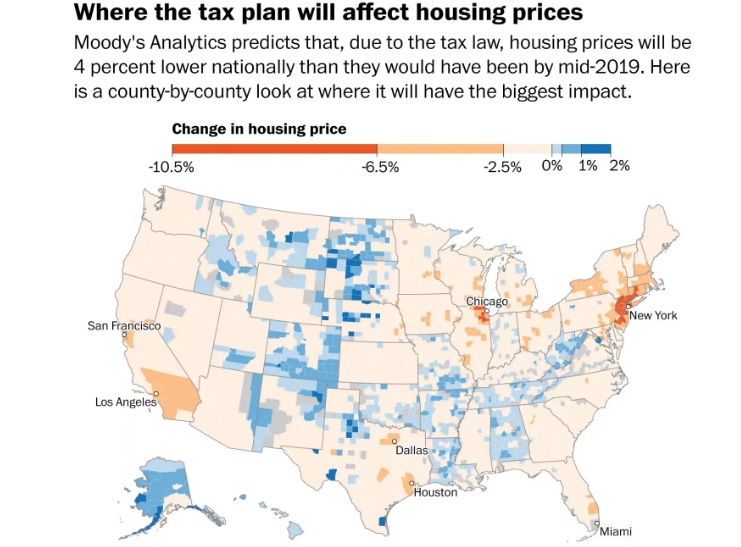

New tax law expected to slow rise of home values, creating winners and losers.

(Washington Post)

By Kathy Orton and Aaron Gregg December 29, 2017

The steady increase in housing prices in many of the nation’s priciest markets, including the Washington region, is expected to slow in coming years, analysts say, as the Republican tax law begins to reshape a significant part of the U.S. economy.

For generations, the tax code has subsidized homeownership, particularly for people in the upper middle class and beyond. The Republican tax legislation, however, pushed in the opposite direction, scaling back subsidies once thought untouchable.

For the government to pay for other tax cuts, which benefits individuals and corporations, the GOP tax plan trims the mortgage interest deduction and property tax deduction, which combined allow some homeowners to take tens of thousands of dollars off their taxable income.

The law allows interest deducted on mortgages only worth up to $750,000, instead of the previously existing $1 million limit. Grandfathered are people who got loans before Dec. 15 into the $1 million thresholds. It also put a $10,000 cap on the amount of state and local taxes, including property taxes, which you can deduct from the federal return.

Economists and housing experts broadly agree the changes will slow price increases in expensive housing markets, though nobody expects housing values to decline, given the overall strength of the economy and the fact that there are relatively few houses for sale in top markets.

Still, experts are debating who wins and loses from the changes, and the reality may turn as much on perception as on the fundamental economics.

Bonnie Casper, a real estate agent with Long & Foster in Bethesda, says the new rules will put a lot of prospective home buyers in wait-and-see mode, which could prompt a slowdown in the market.

“If they’re not going to have a tax benefit, maybe they’ll go rent and not buy,” Casper said. The tax overhaul “could hinder first-time buyers, in particular, and then have a cascading effect.”

Edward Pinto, a housing expert at the American Enterprise Institute, says lower housing prices will prove attractive to first-time home buyers who might have felt exasperated by the rapid increase in home values in recent years.

“Existing homeowners have benefited from that on the backs of first-time home buyers,” Pinto said.

Mark Zandi, chief economist at Moody’s Analytics, a research firm, estimates that in the New York metropolitan region, some counties could see prices 10 percent below where they would have been without the tax bill by the summer of 2019. The central U.S. county will see a decline of 0.8 percent, he predicted.

“House prices suffer under the tax plan,” Zandi wrote in a recent analysis. “The impact on house prices is much greater for higher-priced homes. Homeowners with higher incomes get hit by the tax. That means a disproportionate number of itemizers, and where homeowners have big mortgages and property tax bills.”

According to Moody’s analysis, home prices could deflate by 2 percent in the District, 2.5 percent in Montgomery County and 2.3 percent in Arlington County. Loudoun County is most affected in the region, with a projected 2.6 percent decline in prices relative to where they would have been.

By way of example, if the price of a $500,000 home in the District had risen to $525,000 by the summer of 2019, under the new law it would go up only to $515,000, assuming a 3 percent, rather than 5 percent, increase.

“The biggest impact is probably the psychological impact on buyers,” said Lindsay Reishman, a senior vice president with the real estate firm Compass. “We might see fewer transactions, a little less activity for a while.”

EastTexasRadio.com Powered by Ten Stations

EastTexasRadio.com Powered by Ten Stations